Resume

Resume examples for top Accountant jobs

Use the following guidelines and resume examples to choose the best resume format.

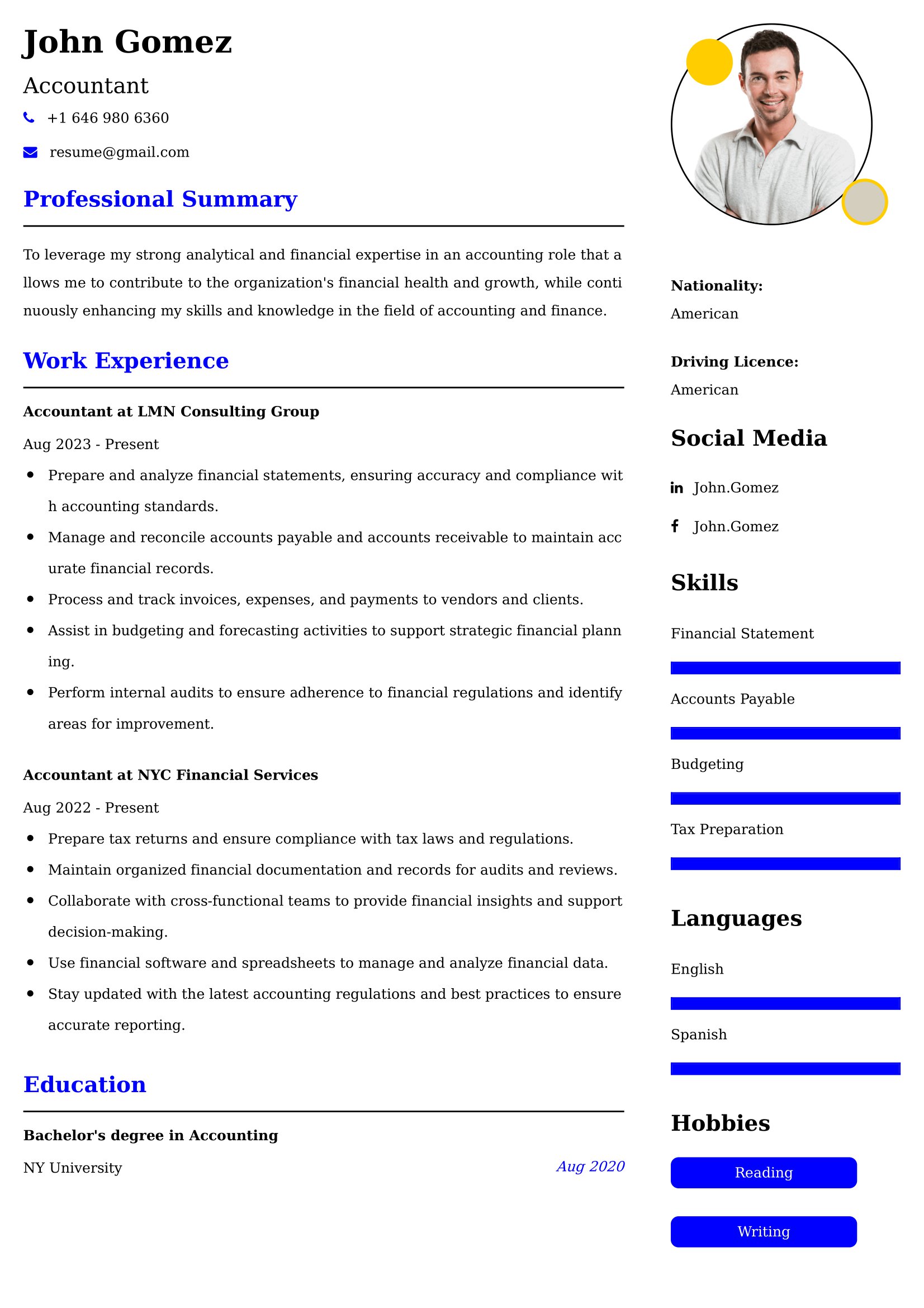

Accountant Resume Sample

About Us:

Welcome to resumebanwao.com, your go-to resource for crafting outstanding accountant resumes. We understand the pivotal role that a well-crafted resume plays in your accounting career. Our mission is to provide you with the guidance and resources to create a standout resume, opening doors to your dream accounting job.

Salary Details (in INR):

In the field of accounting, salaries in India can vary depending on factors like location, experience, and industry. On average, entry-level accountants can expect to earn around 3-5 lakhs per year, while senior accountants with extensive experience may command salaries between 8-15 lakhs annually.

Trends :

- Automation Integration: Accountants are increasingly integrating automation tools to streamline financial processes, reducing manual data entry and enhancing efficiency.

- Data Analysis: Accountants are evolving into data analysts, using data-driven insights to make informed financial decisions.

- Sustainability Reporting: There's a growing emphasis on sustainability reporting, with accountants playing a crucial role in transparent financial reporting related to environmental and social impact.

- Cloud Accounting: The adoption of cloud-based accounting software is on the rise for accessibility and collaboration.

- Regulatory Compliance: Staying updated with changing tax laws and regulations is critical for accurate financial reporting and compliance.

- Remote Work: Accountants are increasingly embracing remote work options, offering a better work-life balance.

Keyskills :

- Financial Analysis: Proficiency in financial analysis is crucial for budgeting, forecasting, and strategic decision-making.

- Software Proficiency: Accountants need to be adept with accounting software like QuickBooks, Tally, SAP, and Excel for efficient financial management.

- Attention to Detail: Accountants must be detail-oriented to spot errors and discrepancies in financial records.

- Communication Skills: Effective communication is vital for collaborating with clients and team members, ensuring clarity in financial discussions.

- Time Management: Efficiently managing tasks and meeting deadlines is essential in the fast-paced world of accounting.

- Ethical Practices: Maintaining high ethical standards and ensuring the confidentiality of financial data is critical for trust and compliance.

Do's and Dont's :

Do's:

- Do Highlight Relevant Skills: Emphasize accounting-related skills such as financial analysis, tax preparation, and software proficiency.

- Do Use Action Words: Start each bullet point in your work experience section with strong action verbs to describe your accomplishments effectively.

- Do Quantify Achievements: Use measurable achievements to demonstrate the impact of your work, such as "Reduced costs by 15% through streamlined financial processes."

- Do Tailor Your Resume: Customize your resume for each job application by highlighting skills and experiences that match the specific role you're applying for.

- Do Include Certifications: Mention relevant certifications like CPA or CMA to showcase your expertise.

- Do Proofread: Ensure your resume is error-free by thoroughly proofreading it or seeking a second opinion.

Don'ts:

- Don't Include Irrelevant Information: Avoid details that aren't relevant to the accounting job you're applying for.

- Don't Use Jargon Without Explanation: Explain any industry-specific terms or abbreviations to ensure clarity.

- Don't Overload with Information: Keep the content concise and focused; avoid overwhelming the reader with excessive details.

- Don't Provide Personal Information: Omit personal details like marital status, religion, or political affiliations, as they are generally not relevant to the job.

- Don't Mention Negative Experiences: Focus on your accomplishments and strengths; don't dwell on negative experiences or failures.

- Don't Forget to Update: Regularly update your resume to include recent experiences, certifications, and achievements.

FAQs:

Q1: What should I include in my accountant resume?

A1: Your accountant resume should highlight your key skills, experience, education, certifications, and achievements, tailored to the specific job you're applying for.

Q2: How can I demonstrate my attention to detail in my resume?

A2: Mention your ability to spot errors and discrepancies in financial records and provide examples of your attention to detail.

Q3: What is the most important software for accountants?

A3: Accounting software like QuickBooks and Excel are widely used. Familiarity with ERP systems like SAP can also be beneficial.

Q4: What qualifications are necessary for an accountant?

A4: Typically, a bachelor's degree in accounting or a related field is required. Professional certifications like CPA or CMA can enhance your credentials and should be included on your resume.

Q5: How can I stay updated with changing tax laws and regulations as an accountant?

A5: Attend tax seminars, subscribe to financial news updates, and consider enrolling in continuing education courses. Mention your commitment to staying updated in this area on your resume.

More Resume Examples for the Next Step in Your Accountant Resume Career jobs

More Cover Examples for the Next Step in Your Accountant Cover Career jobs

- Accountant Cover Letter

- Cost Accountant Cover Letter

- Accounting Assistant Cover Letter

- Accounting Administrator Cover Letter

- Accounting Manager Cover Letter

- Assistant Corporate Controller Cover Letter

- Project Accountant Cover Letter

- Staff Accountant Cover Letter

- Auditor Cover Letter

- Staff Auditor Cover Letter

- Accounting Clerk Cover Letter

Get started with a winning resume template

Resume Showcase: 700+ Real Samples, ATS, HR-Approved Templates!

Step into our Resume Showcase, featuring an expansive collection of 700+ real resume samples. These aren't just any samples; they're meticulously designed to sail through ATS systems, endorsed by HR experts, and dressed in stunning templates. Explore the world of impactful resumes that grab the attention of employers and open doors to career opportunities. Your path to professional success begins right here at resumebanwao.com.

Resume Examples

What clients say about us

Our Resume Are Shortlisted By